Discover the best IRS-approved end-of-year tax strategies to reduce your 2024 tax bill. Learn deductions, credits, filing tips, retirement moves, and money-saving actions Americans should take before Dec 31.

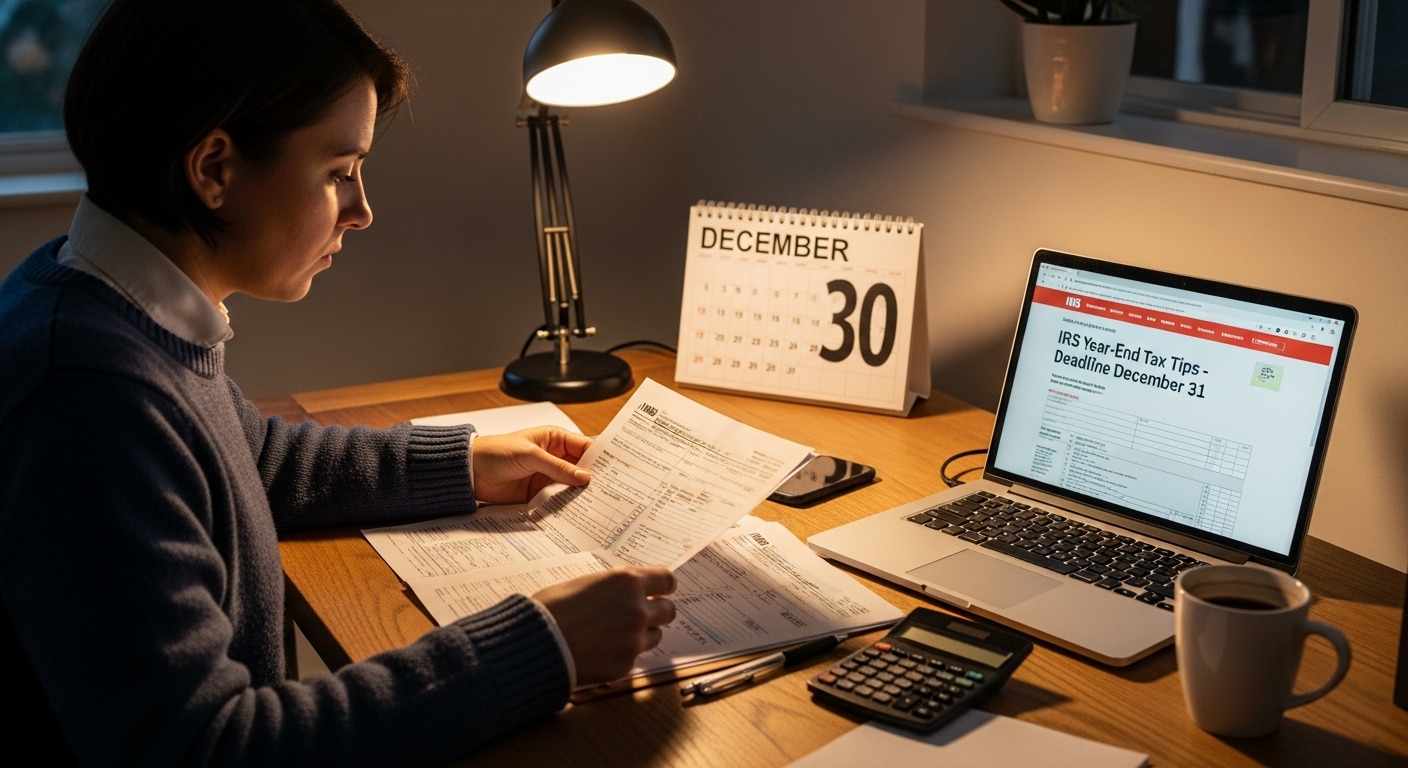

End-of-Year IRS Tax Tips: How to Reduce Your 2024 Tax Bill Before December 31

As the year draws to a close, millions of Americans are searching for ways to legally reduce their tax bill before the clock strikes midnight on December 31, 2024. With the IRS announcing inflation-adjusted changes, higher standard deductions for 2025, and new tax rules affecting credits and retirement plans, November and December are the most important months to plan your taxes.

Whether you’re a salaried employee, small business owner, freelancer, or investor, there are IRS-approved strategies you can still take advantage of—but only before year-end.

This comprehensive guide breaks down the best end-of-year IRS tax tips, backed by expert analysis and current IRS guidelines.

1. Why Year-End Tax Planning Matters

Most tax-saving strategies must be completed before December 31, not tax day in April. According to recent IRS behavioral reports, over 55% of taxpayers leave money on the table simply because they wait until filing season.

The reason year-end planning is powerful:

✔ You still have time to adjust income

✔ You can increase deductions

✔ You can claim credits that phase out once the year ends

✔ You can reduce taxable income strategically

2. IRS Updates for 2024–2025: What Taxpayers Should Know

Here are key IRS updates affecting 2024 filings:

✅ Higher Standard Deduction

For filing in 2025 (for 2024 taxes):

- Single: $14,600

- Married: $29,200

- Head of Household: $21,900

✅ Increased Retirement Contribution Limits

401(k): $23,000

IRA: $7,000

Catch-up contributions (50+): +$7,500 for 401(k)

✅ Inflation-Adjusted Tax Brackets

Slightly wider brackets = more room for tax savings.

These adjustments make end-of-year tax planning even more valuable, especially for middle-income earners.

3. Maximize Your Retirement Contributions

Contributing to retirement accounts is one of the simplest ways to lower taxable income.

✔ 401(k) Contributions Reduce Taxable Income

For example:

If you contribute $5,000, you reduce your taxable income by $5,000.

✔ IRA Deadline: April 2025

But Roth conversions & 401(k) contributions must be done by December 31.

✔ Consider Roth Conversions

If your 2024 income is lower than usual, converting traditional IRA funds to Roth may offer long-term benefits.

4. Take Advantage of Tax-Loss Harvesting

If you invest in stocks, ETFs, or crypto, this IRS strategy is powerful:

✔ Sell Losing Investments to Offset Gains

You can subtract up to:

- Unlimited capital gains offset, plus

- $3,000 against ordinary income

Crypto investors can also benefit due to ongoing price volatility.

5. Boost Itemized Deductions Before December 31

If you itemize, these deductions must occur before year-end:

✔ Mortgage interest

✔ Medical expenses (must exceed 7.5% AGI)

✔ State and local taxes (SALT cap: $10,000)

✔ Charitable donations

✔ Property taxes

Pro Tip:

If your expenses fall just short of itemizing, consider bunching—paying 2025 expenses early.

6. Claim IRS-Approved Tax Credits

⭐ Child Tax Credit

Up to $2,000 per qualifying child

⭐ Earned Income Tax Credit (EITC)

Benefits low to moderate-income workers

⭐ Energy Tax Credits

Home improvement, solar panels, EV purchases

⭐ American Opportunity Credit (AOTC)

Up to $2,500 for education

Credits directly reduce the tax you owe—some even produce refunds.

7. Make Strategic Charitable Donations

Charitable donations made by December 31 can reduce your taxable income.

Ways to donate:

✔ Cash contributions

✔ Donated clothing/household items

✔ Securities (appreciated assets)

✔ Donor-Advised Funds (DAFs)

8. Maximize HSA and FSA Accounts

⭐ HSA Limit 2024

- Individual: $4,150

- Family: $8,300

⭐ FSA “Use It or Lose It”

Spend remaining amounts before they expire.

9. Run an IRS Withholding Check-Up

If you got a new job, changed income, or had kids, check your IRS withholding using the IRS Withholding Estimator.

Adjusting in November or December prevents:

❌ Unexpected tax bills

❌ Underpayment penalties

10. IRS End-of-Year Tips for Small Business Owners

Small businesses can reduce taxes with:

✔ Section 179 expensing

✔ Business equipment purchases

✔ Home office deduction

✔ Vehicle mileage deduction

✔ Bonus depreciation

11. IRS Tips for Gig Workers, Freelancers & Independent Contractors

Gig economy workers must:

✔ Track all income

✔ Write off business expenses

✔ Pay quarterly taxes (final payment due January 15, 2025)

Common deductions:

- Internet

- Laptop

- Home workspace

- Apps and tools

- Travel & mileage

12. Avoid These IRS Audit Triggers

- Unreported income (IRS gets your 1099s too)

- Excessive deductions

- Large charitable donations without receipts

- Mixing personal and business expenses

13. Plan for 2025: Preparing Ahead

Things to consider:

✔ New IRS tax brackets

✔ Upcoming credit changes

✔ Expected refund delays

✔ New W-4 form adjustments

14. Conclusion

Year-end tax planning is the smartest financial move you can make in November and December. With strategic deductions, timely contributions, and knowledge of IRS updates, you can reduce your tax bill significantly while positioning yourself for a stronger 2025.

#IRSTaxTips #TaxPlanning #USATaxes #IRSUpdates #TaxSavings #YearEndTaxes #RetirementPlanning #TaxCredits #TaxDeductions #FinancialPlanning

Frequently Asked Questions (FAQs)

1. What is the last date for year-end IRS tax moves?

Most actions must be completed by December 31, 2024.

2. Can I reduce my tax bill at the last minute?

Yes — through retirement contributions, charitable donations, and tax-loss harvesting.

3. Does the IRS allow deductions for work-from-home?

Only for self-employed individuals, freelancers, and business owners.

4. Are HSA contributions tax-deductible?

Yes — HSAs offer triple tax benefits.

5. How do I check my IRS withholding?

Use the official IRS Withholding Estimator.

6. Can I still contribute to an IRA after December 31?

Yes — until April 2025, but 401(k) contributions close on Dec 31.